Market Research

Definition: The process of gathering, analyzing and interpreting information about a market, about a product or service to be offered for sale in that market, and about the past, present and potential customers for the product or service; research into the characteristics, spending habits, location and needs of your business’s target market, the industry as a whole, and the particular competitors you face

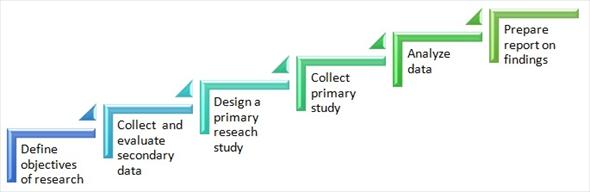

International market research can be used to: determine new markets, test products and determine public opinions on certain strategies. Although different, they all follow a basic step-by-step process:

- Define the objective of the research

- Identify the actions needed to collect the research

- Identify how to achieve those actions

- Identify the sources of information needed to achieve your objective

- Determine how to collect data ie. in person, online, in hard copy

- Conduct analysis of the research collected

- Make recommendations based on the information collected

These general stages can be used as a how-to guide in market research. It is recommended that stages one and three should be thoroughly developed and carefully considered. Once the goals, objectives, and actions are defined, and your carefully planned research campaign completed, you will have sufficient data to make correct conclusions and recommendations.

Primary and Secondary Data

There are two types of data to be used in research.

Secondary Data

Secondary data (existing data) is information that is easily available on the internet or from governmental sources. It can be valuable information for companies in the beginning stages of market selection. Some examples of secondary data are CIA World Facebook and the Virtual Trade Commissioner. It allows companies to determine where the largest markets are, what countries are growing the fastest, which demographic is the largest, and where the business trends are going.

However, secondary data has its limitations. It can become out-of-date quickly and irrelevant to your research. Also in some developing countries, secondary data is either non-existent or out-of-date.

Primary Data

Meanwhile, primary data is documentation and research that you have created or conducted yourself. Primary data is usually completed through these methods:

- Observation

- Focus

- Interviews and surveys

- Experimentation

- Behavioral Data

Observation Research:

Fresh data can be gathered by observing the relevant factors and setting. If a company wants to enter into Aviation industry the researchers should roam around airports, airline offices, and travel agencies to here how travelers talk about the different carriers. The researcher can fly on different airlines to observe the quality of in-flight service. This exploratory research might yield some useful hypotheses about how travelers choose air carriers.

Focus Group Research:

A focus group is a gathering of six to ten people who are invited to spend a few hours with a skilled moderator on discussing a product, service organization, or other marketing entry. The moderator needs to be objective, knowledgeable on the issue, and skilled in-group dynamics. Participants are normally paid a small sum for attending. The meeting is typically held in pleasant surroundings and refreshments are served.

The moderator might start with a broad question, such as “How do you feel about air travel?” The question then moves to how people regard the different airline, different services, and in-flight telephone service. The moderators encourage free and easy discussion, hoping that the group dynamics will reveal deep feelings and thoughts. At the same time the moderator “focuses” the discussion. The discussion recorded through not taking or on audiotape or videotape is subsequently studied to understand consumer beliefs, attitudes, and behavior.

Survey Research:

Surveys are best suited for descriptive research. Companies undertake surveys to learn about people’s knowledge, beliefs preferences, and satisfaction, and to measure these magnitudes in the general population. Aviation company might want to survey how many people know the competitor’s company name, have flown it, prefer it and which other facilities they would like to see in it.

Experimental Research:

When we were in school, we used to carry out various types of experiments in our classes. The experiments were carried to find out the net results when different elements are mixed together.

It is a systematic and scientific approach to research in which the researcher manipulates one or more variables, and controls and measures any change in other variables.

For example – If a company is into manufacturing of engineering products. However, even though the products are good, the market is not being captured. In the end, the company changes various factors including manufacturing, operations, HR and finally sales. Through different cause and effect experiments, the company finds out that there is a direct co-relation between sales training and market coverage of the product. The better the sales person is trained for the technical product, the more positively the market will respond.

If in a car, there are different variables like car color, engine, comfort, mileage etc, then for all the different type of car manufacturers, experimental research was carried out to target the right customers. In essence, one single factor within the manufacturing unit was changed to find its net effect. If the effect was overall positive, the change was implemented or else it was discarded.

Behavioral Data:

Customers leave traces of their purchasing behavior in store scanning data, catalog purchase records and customer database. Much can be learned by analyzing this data. Customers an actual purchase reflects revolved preferences and often are more reliable than statements they offer to market research.

People often report preferences for popular brands and yet the data show that high-income people do not necessarily buy the more expensive brands, contrary to what they might state in interviews; and many low-income people buy some expensive brands. Clearly, companies can learn many useful things about its passengers by analyzing purchase records.

Sources of Data

Secondary Sources

- Country reports

- Articles in business newspapers

- Books

- Studies by consulting firms

- Trade commissioners’ reports

- Reports by commercial banks or international organizations

Primary Sources

- Corporate annual reports

- Records of shareholders meetings

- Corporate websites

- Company product catalogs

- Personal interviews with company executives or with company customers

- Market surveys and focus groups

Steps of the Decision Making Process

In general, the decision making process helps managers and other business professionals solve problems by examining alternative choices and deciding on the best route to take. Using a step-by-step approach is an efficient way to make thoughtful, informed decisions that have a positive impact on your organization’s short- and long-term goals.

The business decision making process is commonly divided into seven steps. Managers may utilize many of these steps without realizing it, but gaining a clearer understanding of best practices can improve the effectiveness of your decisions.

Steps of the Decision Making Process

The following are the seven key steps of the decision making process.

- Identify the decision. The first step in making the right decision is recognizing the problem or opportunity and deciding to address it. Determine why this decision will make a difference to your customers or fellow employees.

- Gather information. Next, it’s time to gather information so that you can make a decision based on facts and data. This requires making a value judgment, determining what information is relevant to the decision at hand, along with how you can get it. Ask yourself what you need to know in order to make the right decision, then actively seek out anyone who needs to be involved.

- Identify alternatives. Once you have a clear understanding of the issue, it’s time to identify the various solutions at your disposal. It’s likely that you have many different options when it comes to making your decision, so it is important to come up with a range of options. This helps you determine which course of action is the best way to achieve your objective.

- Weigh the evidence. In this step, you’ll need to “evaluate for feasibility, acceptability and desirability” to know which alternative is best, according to management experts Phil Higson and Anthony Sturgess. Managers need to be able to weigh pros and cons, then select the option that has the highest chances of success. It may be helpful to seek out a trusted second opinion to gain a new perspective on the issue at hand.

- Choose among alternatives. When it’s time to make your decision, be sure that you understand the risks involved with your chosen route. You may also choose a combination of alternatives now that you fully grasp all relevant information and potential risks.

- Take action. Next, you’ll need to create a plan for implementation. This involves identifying what resources are required and gaining support from employees and stakeholders. Getting others onboard with your decision is a key component of executing your plan effectively, so be prepared to address any questions or concerns that may arise.

- Review your decision. An often-overlooked but important step in the decision making process is evaluating your decision for effectiveness. Ask yourself what you did well and what can be improved next time.

“Even the most experienced business owners can learn from their mistakes … be ready to adapt your plan as necessary, or to switch to another potential solution,” Chron Small Business explains. If you find your decision didn’t work out the way you planned, you may want to revisit some of the previous steps to identify a better choice.

Common Challenges of Decision Making

Although following the steps outlined above will help you make more effective decisions, there are some pitfalls to look out for. Here are common challenges you may face, along with best practices to help you avoid them.

- Having too much or not enough information. Gathering relevant information is key when approaching the decision making process, but it’s important to identify how much background information is truly required. “An overload of information can leave you confused and misguided, and prevents you from following your intuition,” according to Corporate Wellness Magazine.

In addition, relying on one single source of information can lead to bias and misinformation, which can have disastrous effects down the line.

- Misidentifying the problem. In many cases, the issues surrounding your decision will be obvious. However, there will be times when the decision is complex and you aren’t sure where the main issue lies. Conduct thorough research and speak with internal experts who experience the problem firsthand in order to mitigate this. It will save you time and resources in the long run, Corporate Wellness Magazine says.

- Overconfidence in the outcome. Even if you follow the steps of the decision making process, there is still a chance that the outcome won’t be exactly what you had in mind. That’s why it’s so important to identify a valid option that is plausible and achievable. Being overconfident in an unlikely outcome can lead to adverse results.

Decision making is a vital skill in the business workplace, particularly for managers and those in leadership positions. Following a logical procedure like the one outlined here, along with being aware of common challenges, can help ensure both thoughtful decision making and positive results.

Cost of market research

Five main cost affecting elements are; research objective, methodology, target audience, speed, and service provider. Let’s go over the details of these five elements.

a. Define Your Research Objective

According to your objective, market research study methodology is changing, and it’s affecting the cost directly. For example, if you want to test your products and understand the reactions and usage behavior of your target audience, then you need to pick “Product Testing” research. But if you want to change your pricing that resonates with your audience, then you need to use “Pricing Research.” This affects the flow and length of the questionnaire.

b. Identify the Methodology

Your objective affects the methodology directly. Let’s say you’re going to run a “Product Testing” research on a physical product; then you need to consider the cost of giveaway products, and shipping — along with the answers. If you want to run a qualitative research, then you’ll need to run focus groups and in-depth interviews with participants, which has different principles than quantitative studies; which affects the cost.

c. Specify Your Target Audience

The target audience is one of the main differentiators on the pricing. If you’re targeting a tiny amount of people, with really small dense demographics, then your cost will be higher, since it’ll be harder to get answers from these consumers. But, if you’re going to run a classical representative study, then it’ll be easier. In addition to the specifications of your target audience, your business objective affects the cost very impactfully. If you’re going to run a segmentation research, then the audience you need to collect answers from will be higher. But if you’re going to collect rich feedbacks from your target audience on your product, then the audience can be relatively smaller.

d. Speed

Speed is a big differentiator on the cost. If you want your research to be done within 2-days, then you’ll need to pay more to the service provider you’re using (if they’re helping you on reaching out to your target audience). If you don’t have a time limit on what you’re researching on, then you’ll be OK on pricing, since the regular pricing will be applied from service providers.

e. Select a Service Provider

There are several options you can prefer when doing the research. Your options are survey hosting platforms, self-served research companies, and traditional market research companies.

Consumer research

Definition: Consumer Research

Consumer research is the research done on consumers’ preferences, attitudes, loyalty, usage and behavior in a market. It helps in understanding customers so that the marketing campaigns can be designed accordingly.

Consumer research is a part of marketing research.

Market Research deals with processes to understand customers and end consumers which helps the marketer to build market strategy. It helps in analyzing the market using porter’s five forces which deals with the market condition. The strengths, weakness, opportunities and threats are analyzed. They help in defining the marketing goals, generate and define marketing activities, monitor them and improve performance and understanding of the market and consumers. The market research also guides the company in addressing the issues by conducting surveys and get customer opinions.

Marketing research is often partitioned into two categorical pairs

• Consumer marketing research, and

• Business-to-business (B2B) marketing research

Consumer research has two paradigms viz

• Qualitative marketing research- Text analysis

• Quantitative marketing research- Number analysis

Consumer research Process

Consumer Research Methods

Market research is often needed to ensure that we produce what customers really want and not what we think they want.

Primary vs. secondary research methods. There are two main approaches to marketing. Secondary research involves using information that others have already put together. For example, if you are thinking about starting a business making clothes for tall people, you don’t need to question people about how tall they are to find out how many tall people exist—that information has already been published by the U.S. Government. Primary research, in contrast, is research that you design and conduct yourself. For example, you may need to find out whether consumers would prefer that your soft drinks be sweater or tarter.

Research will often help us reduce risksassociated with a new product, but it cannot take the risk away entirely. It is also important to ascertain whether the research has been complete. For example, Coca Cola did a great deal of research prior to releasing the New Coke, and consumers seemed to prefer the taste. However, consumers were not prepared to have this drink replace traditional Coke.

Industrial research – Definition

“Industrial research means the planned research or critical investigation aimed at the acquisition of new knowledge and skills for developing new products, processes or services or for bringing about a significant improvement in existing products, processes or services. It comprises the creation of components of complex systems, which is necessary for the industrial research, notably for generic technology validation, to the exclusion of prototypes.”

Why Is Research So Important?

Industry Research is a topic most people don’t think much about, but in reality it is critically important to our everyday business. In fact, research provides a great manybenefits, including:

- Serving as a guidepost for strategic decisions.

- Internally at companies, it gets everyone on the same page, both veterans and newcomers alike, by providing a common data set from which everyone can draw.

- Providing industry benchmarks against which a company’s key performance indicators can be compared.

- Dispelling myths and providing ammunition for fighting back against misstatements by industry critics.

- Bringing a mission-critical understanding of the general public’s feelings and opinions on matters ranging from the personal service they get in the traditional retail environment to their trust of the direct selling industry as a whole.

Whether association and government affairs professionals are discussing the merits of direct selling with legislators, regulators and consumer protection groups, or whether communications professionals are presenting the industry to journalists, investment analysts and the general public, research is what provides the necessary data.